Property transfers in the UAE can be lucrative but come with significant risks, particularly for sellers and new home buyers. Fraudulent activities like flipping scams, fake buyers, unverified agents, and payment fraud are just some of the challenges in navigating property transfers. At ValuGate, we provide expert guidance to ensure your transactions are secure, legally compliant, and hassle-free.

Our Conveyancing services:

Common Legal Issues in Property Transfers

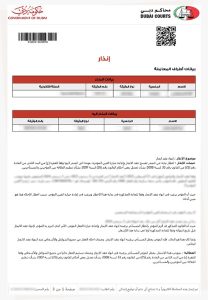

Property Blocking and Ownership Disputes

Properties under legal dispute or with unclear ownership status can delay or derail the transfer process.

Fraudulent Flipping

Unethical buyers may secure properties with minimal down payment, reselling them at inflated prices before completing the original purchase, leaving sellers at financial and legal risk.

Fake Buyers and Payment Fraud

Fraudsters may pose as serious buyers, presenting falsified documents or using fake bank drafts and bounced checks to deceive sellers.

Unverified or Fake Agents

Unlicensed agents may undervalue properties, use fraudulent documentation, or scam both buyers and sellers.

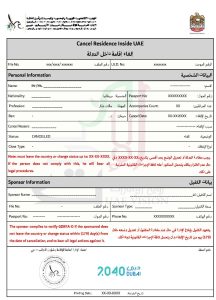

Unvalidated Form F (MOU)

The Memorandum of Understanding (MOU), also known as Form F, is a critical document outlining agreed terms. Errors, omissions, or invalid digital forms can jeopardize the entire transfer process.

Read more: Understanding the Property Valuation Process During Conveyancing

Non-Adherence to AML Compliance

Anti-Money Laundering (AML) regulations require funds used in property transfers to be transparent, traceable, and compliant with UAE laws. Non-compliance can lead to serious legal consequences.

Challenges with Fund Confirmation and NOCs

Delays in confirming buyer funds or obtaining the developer’s No Objection Certificate (NOC) can halt transactions and create unnecessary complications.

Read more: How Much Do Conveyancing Services Cost?

How to Avoid Legal Issues in Property Transfers

Perform Comprehensive KYC and Document Reviews

-

- Ensure all relevant documents, including title deeds, Form F (MOU), payment terms, and buyer credentials, are thoroughly reviewed by qualified professionals or the conveyancing team.

- Verify buyer identities and financial credibility through robust KYC checks.

Validate Form F and Other Legal Documents

-

- Confirm the MOU is accurately filled, digitally signed, and compliant with RERA standards.

- Cross-check title deeds, NOCs, and other legal documents with official records.

Beware of Flipping and Fraudulent Buyers

-

- Avoid buyers proposing overly complex payment structures or minimal down payments.

- Confirm that buyers intend to complete the transaction themselves and are not flipping the property prematurely.

Work with Certified Agents Only

-

- Engage RERA-certified agents and avoid deals from unlicensed brokers.

- Request credentials and verify them with the Dubai Land Department (DLD).

Secure Payment Channels

-

- Use escrow accounts or other secure payment methods approved by the Dubai Land Department (DLD) to transfer funds. Always verify account details with the concerned parties directly.

Ensure AML Compliance

-

- Validate the source of funds used in the transaction to avoid dealing with illicit money.

- Maintain detailed records and report suspicious activity as required under UAE laws.

Obtain Fund Confirmation and Developer’s NOC

-

- Confirm the buyer’s funds are available and legitimate before proceeding with the transfer.

- Work closely with the developer to secure the NOC early to avoid delays.

Partner with Trusted Professionals

-

- Engage conveyancing experts like ValuGate to manage the legal and procedural aspects of the transfer.

- Consult a real estate lawyer for added protection and dispute resolution.

Read more: Documents Needed to Transfer a Property When You Buy and Sell

Why Choose ValuGate?

At ValuGate, we understand the complexities and risks involved in property transfers. Whether you are a first-time home buyer or a seller navigating fraudulent challenges, our team offers end-to-end solutions tailored to your needs. We ensure:

- Comprehensive verification of buyers, agents, and documentation.

- Secure fund handling and AML compliance.

- Timely processing of developer NOCs and fund confirmations.

With ValuGate, you can trust that your property transfer is legally sound, transparent, and stress-free.

Contact us today to experience seamless and secure property transfers in the UAE.